tructiepbongda2.site Prices

Prices

How Does Selling A Stock Short Work

Short selling is selling securities you don't own hoping the prices will crash in near future. And Margin account is mandatory. How Does Short Selling Work? Short sellers open a position by borrowing stock, generally from a broker, to sell and buy back at a date in the future for less. When you sell short you borrow shares from your broker and sell them. You have to have a certain amount of collateral (assets) in your account. Short Selling occurs when an investor sells all the shares that he does not own at the time of a trade. This article will explain the several significant. Schematic representation of naked short selling of stock shares in two steps. The short seller sells shares without owning them. They later purchase and deliver. (Short selling involves borrowing a security whose price you think is going to fall from your brokerage and selling it on the open market. Your plan is to then. To short-sell a stock, you borrow shares from your brokerage firm, sell them on the open market and, if the share price declines as hoped and anticipated, buy. Short selling works by borrowing shares from your broker and immediately selling them on the market. Once the share price drops, you buy back the shares cheaper. The most basic is physical selling short or short-selling, by which the short seller borrows an asset (often a security such as a share of stock or a bond) and. Short selling is selling securities you don't own hoping the prices will crash in near future. And Margin account is mandatory. How Does Short Selling Work? Short sellers open a position by borrowing stock, generally from a broker, to sell and buy back at a date in the future for less. When you sell short you borrow shares from your broker and sell them. You have to have a certain amount of collateral (assets) in your account. Short Selling occurs when an investor sells all the shares that he does not own at the time of a trade. This article will explain the several significant. Schematic representation of naked short selling of stock shares in two steps. The short seller sells shares without owning them. They later purchase and deliver. (Short selling involves borrowing a security whose price you think is going to fall from your brokerage and selling it on the open market. Your plan is to then. To short-sell a stock, you borrow shares from your brokerage firm, sell them on the open market and, if the share price declines as hoped and anticipated, buy. Short selling works by borrowing shares from your broker and immediately selling them on the market. Once the share price drops, you buy back the shares cheaper. The most basic is physical selling short or short-selling, by which the short seller borrows an asset (often a security such as a share of stock or a bond) and.

By short selling, traders can profit when the value of an asset depreciates. Learn how to shorting a stock, how to buy long & sell short. The short seller receives cash for selling someone else's shares, and it is typically deposited in an interest-bearing account. This income would help the net. Therefore, that's how shorting works: You borrow shares from your broker; you sell them on the market at a high price. Later on, hopefully, you buy them back at. Successful short selling involves borrowing stocks, selling the borrowed stock and buying them back at a lower price. Find out how to short stocks here. A “short” position is generally the sale of a stock you do not own. Investors who sell short believe the price of the stock will decrease in value. When you short you sell the stocks and then buy them back when the price goes down, earning you a profit. If you do not own any shares of XYZ stock however you. How to Short a Stock. As explained, short selling refers to borrowing stocks (usually from your broker) so as to sell them at the prevailing market prices. The traditional method of shorting stocks involves borrowing shares from someone who already owns them and selling them at the current market price – if there. Unlike buying stocks, where the maximum loss is the initial investment, short selling carries unlimited loss potential because there is no cap on how high a. How Short Selling Works The mechanics of short selling involve borrowing shares in order to (short) sell them and then buying them back (covering the short). To close a short position, a trader buys the shares back on the market—hopefully at a price less than at which they borrowed the asset—and. Shorting a stock, also known as short selling, is one way to potentially profit from a stock's price decline. When investors think a stock's price will fall. Understand how shorting works · Identify the stock that you want to sell short · Create a tastytrade margin account or log in · Decide how you want to short the. Short selling or Selling Short is the act of borrowing a security from someone else, usually a broker, selling it and later repurchasing the stock in the hopes. Buying stocks on a Long Position is the action of purchasing shares of stock(s) anticipating the stock's value will rise over time. Short selling is a popular trading technique for investors with a lot of experience. It can create large profits. But it also involves the potential to lose. How does short-selling work? Short-selling works by the trader borrowing the underlying asset from a trading broker and then immediately selling it at the. Shorting a stock is the act of betting against a company's share price, expecting it to decline. In this strategy, you borrow shares to sell them at the. This is the process of selling “borrowed” stock at the current price, then closing the deal by purchasing the stock at a future time. What this essentially. Short selling, or shorting, means an investor expects a stock to lose value · In a short sell, investors borrow stocks and immediately sell in hopes of making a.

Diversification In Finance

Diversification is very important to reduce portfolio risk, and reduce the risk that you might not be able to meet your future goals. The concept of diversification Most people intuitively know the value of diversifying an investment or a portfolio. “Do not put all of your eggs in one basket. Diversification is the practice of spreading your investments around so that your exposure to any one type of asset is limited. By diversifying, you spread your money between different investment types to reduce the overall impact of risk when investing. Spreading your investments. Diversification means lowering your risk by spreading money across and within different asset classes, such as stocks, bonds and cash. Investors who diversify their portfolios are effectively spreading out their risk, which can help mitigate chance of losing money. In finance, diversification is the process of allocating capital in a way that reduces the exposure to any one particular asset or risk. Diversification is a risk management technique that mitigates risk by allocating investments across different financial instruments, industries, and several. Diversification is the technique of spreading investments across several different assets to help minimize risk. Diversification is very important to reduce portfolio risk, and reduce the risk that you might not be able to meet your future goals. The concept of diversification Most people intuitively know the value of diversifying an investment or a portfolio. “Do not put all of your eggs in one basket. Diversification is the practice of spreading your investments around so that your exposure to any one type of asset is limited. By diversifying, you spread your money between different investment types to reduce the overall impact of risk when investing. Spreading your investments. Diversification means lowering your risk by spreading money across and within different asset classes, such as stocks, bonds and cash. Investors who diversify their portfolios are effectively spreading out their risk, which can help mitigate chance of losing money. In finance, diversification is the process of allocating capital in a way that reduces the exposure to any one particular asset or risk. Diversification is a risk management technique that mitigates risk by allocating investments across different financial instruments, industries, and several. Diversification is the technique of spreading investments across several different assets to help minimize risk.

Diversification lowers the risk of your investment portfolio Loans, money and personal finance advice, Other feedback/suggestion. You would. Asset allocation & diversification: The pillars of your financial plan · When it comes to investing in the stock market, there are very few absolutes. · Even when. The globalized financial market will reduce the risk premium of a home country's assets, if the ratio of standard deviations of the asset returns in the home. Pros and cons of portfolio diversification · Risk mitigation · Enhanced potential for returns · Reduced volatility · Liquidity management · Alignment with financial. Diversification is a technique of allocating portfolio resources or capital to a variety of tructiepbongda2.site goal of diversification is to mitigate losses. Simply owning many stocks or mutual funds will not necessarily achieve diversification. To be diversified, the key is to select asset classes that are unlikely. Diversification can be done through asset allocation by combining different asset classes. It can also be done within asset classes, either geographically (see. The idea of diversification is one of the most powerful ideas in Finance, and probably the only. “free lunch” available to investors. That's because risk and reward go together in the financial markets. So, anything that reduces your risk will also reduce your return. Give yourself permission. Diversification is a fundamental investment strategy that aims to minimize risk by spreading your investments across a range of different assets. A diversified portfolio should include a mix of asset classes, diversification within asset classes, and adding foreign assets to your investment strategy. Diversification is a strategy of spreading your money around with many different investments. Because investments don't usually move as a group, diversification. Diversification essentially means allocating your investment dollars strategically among different assets and asset categories to help manage risk. diversification in Finance Diversification is the act of investing in different industries, areas, countries, and types of financial instruments, to reduce. This is diversification - A type of investment strategy that reduces risk by spreading an investment portfolio across different financial products. Diversification is the process of spreading investments across different asset classes, industries, and geographic regions to reduce the overall risk of an. A properly-diversified portfolio can help you achieve more consistent returns over time, which may improve the opportunity to attain your ultimate financial. Diversification works because it takes the long view of investing. It's nearly impossible to predict the short-term performance of the financial markets. In. Diversification is the process of spreading investments across different asset classes, industries, and geographic regions to reduce the overall risk of an. To start, you need to make sure your asset mix (e.g., stocks, bonds, and short-term investments) is aligned to your investment time frame, financial needs, and.

Carbon Offset Programs For Companies

Companies can actively reduce their carbon emissions through energy conservation, recycling, and more. VERIFIED CARBON OFFSETS SUPPORT. EMISSIONS REDUCTION. Terrapass carbon credits fund projects like forestry, landfill gas capture, and industrial emission reduction to help reduce global carbon emissions. Previous. 75 votes, 67 comments. Anyone have good, legitimate carbon offset programs? I recently took a flight and I regret it immensely. Every tonne of emissions reduced by an environmental project creates one carbon offset or carbon credit. Companies can invest in these projects directly or buy. A Carbon offset is a way to compensate for your emissions by funding an equivalent carbon dioxide saving elsewhere. Our everyday actions, at home and at work. Find a wide range of carbon offset products especially designed for businesses/companies to reduce carbon emissions & stand against climate change. 6 of the best carbon offset programs for companies · 1. GreenPerk · 2. TerraPass · 3. NativeEnergy · 4. Sustainable Travel International · 5. Carbon Checkout. By engaging in a carbon offsetting program, businesses can significantly reduce their carbon emissions and minimize their environmental impact. These. IATA's carbon offset program brings standardization and makes it These programs are aimed at passengers and companies that wish to understand the CO2. Companies can actively reduce their carbon emissions through energy conservation, recycling, and more. VERIFIED CARBON OFFSETS SUPPORT. EMISSIONS REDUCTION. Terrapass carbon credits fund projects like forestry, landfill gas capture, and industrial emission reduction to help reduce global carbon emissions. Previous. 75 votes, 67 comments. Anyone have good, legitimate carbon offset programs? I recently took a flight and I regret it immensely. Every tonne of emissions reduced by an environmental project creates one carbon offset or carbon credit. Companies can invest in these projects directly or buy. A Carbon offset is a way to compensate for your emissions by funding an equivalent carbon dioxide saving elsewhere. Our everyday actions, at home and at work. Find a wide range of carbon offset products especially designed for businesses/companies to reduce carbon emissions & stand against climate change. 6 of the best carbon offset programs for companies · 1. GreenPerk · 2. TerraPass · 3. NativeEnergy · 4. Sustainable Travel International · 5. Carbon Checkout. By engaging in a carbon offsetting program, businesses can significantly reduce their carbon emissions and minimize their environmental impact. These. IATA's carbon offset program brings standardization and makes it These programs are aimed at passengers and companies that wish to understand the CO2.

When an entity invests in a carbon offsetting program, it receives carbon credit or offset credit, which account for the net climate benefits that one entity. The Compliance Offset Program is an important cost-containment element within the broader Cap-and-Trade Program. The California Air Resources Board issues. We help companies calculate, reduce, and offset their carbon footprint. Become a carbon neutral business carbon offset program and showcase your impact in an. Through the strategic use of carbon offsets, Native helps businesses and corporations meet their sustainability goals. What is a carbon offset? Carbon offsets. Carbon offsetting enables business to meet ambitious climate goals, puts a price on carbon to incentivize further action, and provides critical finance to. The Verified Carbon Standard (VCS) Program is the world's most widely used greenhouse gas (GHG) crediting program. It drives finance toward activities that. Add transparent, high-quality carbon offsets to your sustainability strategy with CarbonClick. Certified carbon offset provider. Trusted B Corp. The best carbon offsets for businesses in terms of overall impact are Ecologi, Terrapass, Climeworks. The projects are implemented in developing countries and are rewarded with Certified Emission Reductions (CERs), a type of carbon offset measured in tonnes of. Launched two of the first transportation-related carbon offset programs · Registered the first project to issue California Compliance Offsets · Registered first. Carbon offsets are tradable “rights” or certificates linked to activities that lower the amount of carbon dioxide (CO2) in the atmosphere. Cool Effect is one of the best carbon offset providers in because we have made the process as straightforward as possible, allowing you to buy carbon. By engaging in a carbon offsetting program, businesses can significantly reduce their carbon emissions and minimize their environmental impact. These. To offset their carbon footprint, the company can work with a carbon offsetting broker. The broker calculates the company's emissions and charges a fee based on. Purchase Carbon Credits A whopping 50, pounds a year!* That's the average American's carbon footprint from our home, work, travel and everything else we do. There are now a variety of independent carbon crediting programs primarily serving the voluntary market comprised primarily of corporations wishing to make. Carbon offsets enable organizations to pursue emissions reduction targets without having to make drastic changes to ongoing business operations. Operating out. We wrote an article about the 4 best carbon offsetting programs (gold standard, climate action reserve, Verra and American Carbon Registry) and. A company will purchase credits from these landowners that represent the avoided emissions to compensate for its pollution. The money the landowner makes from. With climate change a top concern among consumers, investors, and employees, companies must take swift steps to lessen their carbon footprint. Our carbon offset.

401k Bonus Contribution Limit

Match formulas vary, but a common setup is for employers to contribute $1 for every $1 an employee contributes up to 3% of their salary, then 50 cents on the. This is the percentage of your annual salary you contribute to your (k) plan each year. Your annual (k) contribution is subject to maximum limits. The (k) contribution limit for is $22, for employee contributions and $66, for combined employee and employer contributions. If you're age 50 or. A common employer matching formula is 50% of (k) employee contributions, up to a certain contribution limit (typically a maximum of 6%). This can be a. The IRS lets you contribute a total of $66, into your k, so after subtracting out your maximum $22, contribution + your company match. If you want to contribute more or less at specific times, such as when receiving a bonus, simply log into your participant dashboard and elect a new rate. It's. According to the IRS, you can contribute up to $20, to your (k) for By comparison, the contribution limit for was $19, This number only. It's a good thing to contribute to your company's (k) or other employer The maximum annual contribution for both accounts in is $6, (or. Contribution Limits. The limit for employee contributions to a (k) in is $23, for those under For those 50 or older, the. Match formulas vary, but a common setup is for employers to contribute $1 for every $1 an employee contributes up to 3% of their salary, then 50 cents on the. This is the percentage of your annual salary you contribute to your (k) plan each year. Your annual (k) contribution is subject to maximum limits. The (k) contribution limit for is $22, for employee contributions and $66, for combined employee and employer contributions. If you're age 50 or. A common employer matching formula is 50% of (k) employee contributions, up to a certain contribution limit (typically a maximum of 6%). This can be a. The IRS lets you contribute a total of $66, into your k, so after subtracting out your maximum $22, contribution + your company match. If you want to contribute more or less at specific times, such as when receiving a bonus, simply log into your participant dashboard and elect a new rate. It's. According to the IRS, you can contribute up to $20, to your (k) for By comparison, the contribution limit for was $19, This number only. It's a good thing to contribute to your company's (k) or other employer The maximum annual contribution for both accounts in is $6, (or. Contribution Limits. The limit for employee contributions to a (k) in is $23, for those under For those 50 or older, the.

For example, in California, the bonus tax rate is approximately 45%, so your maximum Roth or after-tax bonus contribution to your (k) cannot exceed. Examples of defined contribution plans include (k) plans, (b) plans A Profit Sharing Plan or Stock Bonus Plan is a defined contribution plan. The (k) contribution limit is $23, (). Those 50 and older are allowed a catch-up contribution of $7, There is usually some form of employer match. So, if your salary deferral limit is $23, but your employer adds $5, as a matching contribution, you should still be able to contribute $23, There may. For and , you can contribute up to $19, or $20, respectively. If you hit the IRS cap too early, you could miss out on matching contributions from. bonus plan, a complete discontinuance of contributions under such plan. (d) Contribution limit on owner-employees. A trust forming part of a pension. In , you can contribute up to $23, to your (k). Your contributions can be entirely pre-tax or Roth (if your plan allows for Roth contributions), or. An employer will establish an aggregate maximum contribution between the (k) Plan and the contribution in order to receive a bonus. The bonus has. You can deduct up to the contribution limit, if you're single and your Modified Adjusted Gross Income (MAGI) is $77, or less for You can take a partial. Mary may contribute to the plan until she reaches her annual deferral limit of $19, even though her compensation will exceed the annual limit of $, in. Yes, a bonus may be contributed to a (k) retirement plan. Doing so will allow the employee to defer the income taxes on the bonus, but social. Roth (k) contribution limits The maximum amount you can contribute to a Roth (k) for is $23, if you're younger than age This is an. (k) “BONUS” CONTRIBUTION FORM. Participant Information. Participant Name Eligible Compensation under the Plan is limited to the applicable dollar limit, in. However, your annual contribution is also subject to certain maximum total contributions per year. The annual maximum for is $18, If you are age 50 or. * Keep in mind that the bonus contribution percentage is calculated based Understanding Lam Research (k) Plan Contribution Limits. Contributions. Answer: It depends. The way to handle bonus for purposes of employee and employer contributions depend on the definition of compensation in your plan document. (d) Contribution limit on owner-employees. A trust forming part of a pension or profit-sharing plan which provides contributions or benefits for employees. If you haven't reached the contribution limits on your (k) or traditional IRA, putting your bonus into one of these plans can be a really smart move. You. 50 and older: $30, ($23, + $7, catch-up contribution). These contributions can be made on a traditional, pre-tax, or Roth basis. The.

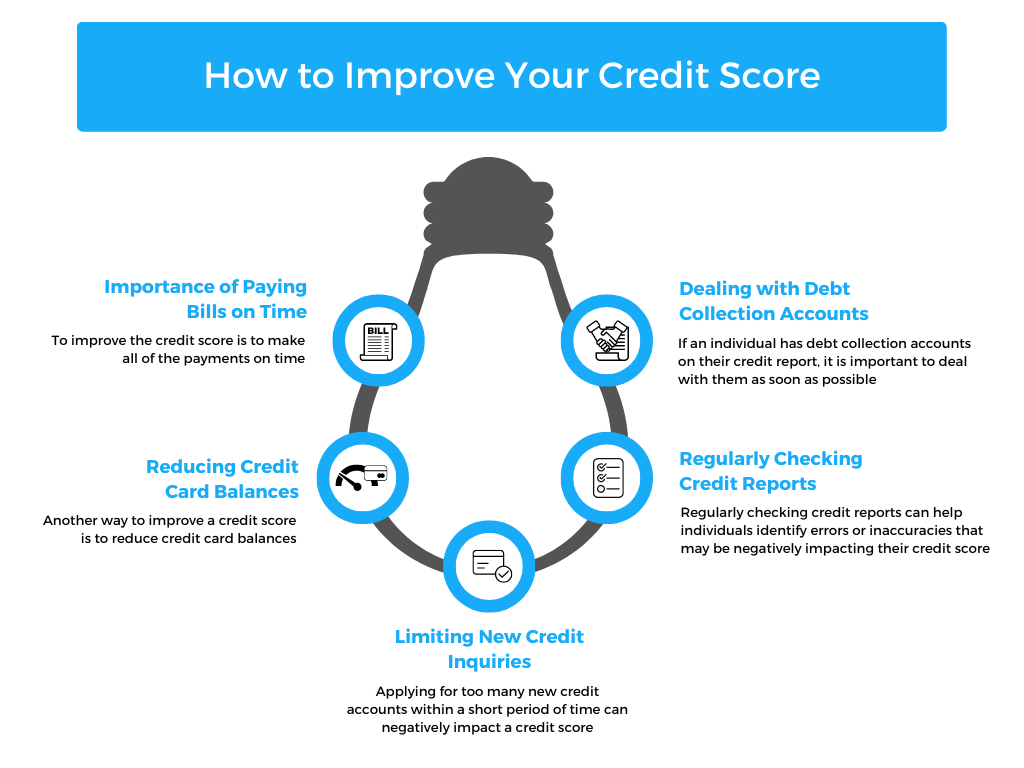

How Quickly Does Credit Score Change After Paying Off Debt

If you can pay off your credit card balance in full each month, that helps. If you make your monthly mortgage payment every month without delay, that's huge. In. If you haven't used credit before, it usually takes at least six months to generate a credit score – and longer to earn a good or excellent score. It's usually. The average credit score recovery time after closing an account (for those with poor to fair credit) is three months, according to Bankrate. Making a series of. That one to two years starts after the last credit card is settled. Here is a short video about what happens to credit when you settle debt. How long does information stay on my credit file? Certain debts stay on your credit file for six years. They are taken off even if the debt is not paid. These. Create a plan · Contact all creditors. · Pay off delinquent accounts first, then debts with higher interest rates; you may save money · Consider a debt. Typically, it takes months to see an improvement in your credit score after paying off an old debt, though some changes might be noticeable. It can be nail-biting to wait for your credit score to update after paying off debt. Especially if that bump in your score is helping you get approved for a. How long it takes: Your length of credit history is established over the course of several years. However, if you close an old account or open multiple new. If you can pay off your credit card balance in full each month, that helps. If you make your monthly mortgage payment every month without delay, that's huge. In. If you haven't used credit before, it usually takes at least six months to generate a credit score – and longer to earn a good or excellent score. It's usually. The average credit score recovery time after closing an account (for those with poor to fair credit) is three months, according to Bankrate. Making a series of. That one to two years starts after the last credit card is settled. Here is a short video about what happens to credit when you settle debt. How long does information stay on my credit file? Certain debts stay on your credit file for six years. They are taken off even if the debt is not paid. These. Create a plan · Contact all creditors. · Pay off delinquent accounts first, then debts with higher interest rates; you may save money · Consider a debt. Typically, it takes months to see an improvement in your credit score after paying off an old debt, though some changes might be noticeable. It can be nail-biting to wait for your credit score to update after paying off debt. Especially if that bump in your score is helping you get approved for a. How long it takes: Your length of credit history is established over the course of several years. However, if you close an old account or open multiple new.

It gives scoring models less information to work with. Your credit score provides a picture of how you've managed debt in the past and in the present. Once you. The longer you pay your bills on time after being late, the more your FICO Scores should increase. paying them off on time will raise your credit score in the. Credit reporting companies must investigate all disputes, usually within 30 days, unless they consider your dispute frivolous. They will forward your dispute to. Research shows that your track record of payment tends to be the strongest predictor of the likelihood that you'll pay all debts as agreed to. And as you can. Lenders usually report updated information every days, so it's possible you might receive an updated credit score each month. often does after the settlement's complete), your credit score gets dinged. Is It Better to Pay Off a Debt or Settle? Debt settlement is one of the. The report is almost always negative, even if the debt has been paid off. It is best to avoid bankruptcy, tax liens or court judgments because those public. The length of time it will take to improve your credit scores depends on your unique financial situation, but you may see a change as soon as 30 to 45 days. Hard inquiries fall off after two years (and only impact FICO scores for the first 12 months). Chapter 7 bankruptcies fall off 10 years. All other negative. credit line, which can help if you're unable to quickly pay down existing credit card debt. Before you apply, determine the following: What type of credit. There are multiple reasons your credit score could drop after paying off debt, such as changing your credit mix, reducing your credit limit, decreasing average. If you would like to boost your credit score, there are a number of quick, simple things that you can do. While it might take a few months to see an improvement. Credit scores refresh at different times throughout the month and there may be times where it takes a few days or weeks before your score updates. And even if. For instance, paying all your credit card bills on time for one month can be good for your scores. But paying on time over months or years can have an even. Make Your Payments on Time Lenders look closely at payment history to make sure you'll pay your loans on time and in full. With payment history making up. When do credit bureaus update credit scores? Your credit report could change daily, or even more than once a day. Creditors usually send information to the. How long does it take for credit scores to change after paying off debt? After you pay off a debt, it can take anywhere from 30 to 45 days to reflect the. According to most credit scoring models, paying off a collection account doesn't stop it from having an effect on your credit. You'll usually have to wait until. Since your credit score is based on your current credit report, your score changes every time your credit report changes. Financial advisors often offer these. The report is almost always negative, even if the debt has been paid off. It is best to avoid bankruptcy, tax liens or court judgments because those public.

Qlac

Qualified Longevity Annuity Contract (QLAC) A longevity annuity is a type of fixed annuity. It is often sold to investors around retirement age as a way to. Once you begin taking a distribution those distributions continue for the rest of your life. Therefore, if for example you choose to invest in a QLAC and have. The primary purpose of a QLAC is to provide a guaranteed income stream for life starting at a future date, with payments beginning as late as age As we mentioned earlier, a QLAC is a type of deferred income annuity. At its most basic, you use qualified assets to purchase a QLAC. Qualified money is money. What Is a QLAC? A Qualified Longevity Annuity Contract, or QLAC for short, is a special type of longevity annuity purchased with tax-deferred savings from. QLAC Details. QLACs, DIAs, and SPIAs are all in the same lifetime income family. All have no moving parts, no annual fees, and are a simple and easy to. 01 What is a QLAC? A QLAC is a deferred income annuity contract that allows a portion of tax-qualified assets to be used to purchase future lifetime. Go2Income provides a QLAC annuity calculator to help you customize your QLAC. Also planning tools and information on how QLAC fits into retirement. The MetLife Retirement Income Insurance® QLAC which provides employees with guaranteed lifetime income later in retirement. Qualified Longevity Annuity Contract (QLAC) A longevity annuity is a type of fixed annuity. It is often sold to investors around retirement age as a way to. Once you begin taking a distribution those distributions continue for the rest of your life. Therefore, if for example you choose to invest in a QLAC and have. The primary purpose of a QLAC is to provide a guaranteed income stream for life starting at a future date, with payments beginning as late as age As we mentioned earlier, a QLAC is a type of deferred income annuity. At its most basic, you use qualified assets to purchase a QLAC. Qualified money is money. What Is a QLAC? A Qualified Longevity Annuity Contract, or QLAC for short, is a special type of longevity annuity purchased with tax-deferred savings from. QLAC Details. QLACs, DIAs, and SPIAs are all in the same lifetime income family. All have no moving parts, no annual fees, and are a simple and easy to. 01 What is a QLAC? A QLAC is a deferred income annuity contract that allows a portion of tax-qualified assets to be used to purchase future lifetime. Go2Income provides a QLAC annuity calculator to help you customize your QLAC. Also planning tools and information on how QLAC fits into retirement. The MetLife Retirement Income Insurance® QLAC which provides employees with guaranteed lifetime income later in retirement.

Many retirees are concerned about outliving their retirement savings. Learn how a Qualified Longevity Annuity Contract (QLAC) can provide lifetime income. Best QLAC Rates in August Here are the best QLAC (Qualified Longevity Annuity Contract) rates available on a $, policy. Amounts shown above are. A Qualified Longevity Annuity Contract (QLAC) is a deferred annuity that is funded from an Individual Retirement Account (IRA) or qualified retirement plan. QLAC is an acronym for a Qualified Longevity Annuity Contract. QLAC's provide guaranteed monthly payments until death and like many other annuity contracts are. A QLAC is a DIA that is funded with qualified pretax retirement assets and can start payments later than age 73 or 75 (required minimum distribution (RMD). A Qualified Longevity Annuity Contract (QLAC) is a specific type of deferred income annuity that you can purchase with funds from your retirement accounts, such. By purchasing a QLAC, your clients are effectively reducing the amount of qualified funds that is used to calculate their RMDs. The QLAC reduces your clients'. A Qualified Longevity Annuity Contract (QLAC) provides an alternative investment option for retirement plans like (k)s, (b)s or IRAs. Bottom line: The longer the deferral period, the larger the income payout amount. QLACs Bring Added Advantages. A qualified longevity annuity contract (QLAC) is. A Qualified Longevity Annuity Contract (QLAC), also known as a "longevity contract", is a deferred annuity funded inside a Qualified Plan with the intent of. Qualified Longevity Annuity Contract (QLAC) Requirements. 1) Over your lifetime, you cannot allocate more than $, from all of your IRAs. 2) Payments can. A qualified longevity annuity contract allows you to reduce your taxes and put off required minimum distributions (RMDs) from retirement accounts until an age. For clients not interested in taking RMDs at age 73, a QLAC can help. Defer IRA payments - and taxes - up to age One strategy is to establish Pacific Secure Income as a qualified longevity annuity contract (QLAC). Lower Your Required Minimum Distributions (RMDs). An RMD is. A Qualified Longevity Annuity Contract (QLAC) is a type of deferred income annuity designed to provide a guaranteed income stream in retirement while offering. Qualified Longevity Annuity Contract (QLAC). The IRS recently released new rules regarding longevity annuities. The new rules, announced July , are meant to. A QLAC in effect allows for the transferring of funds that otherwise would be required to be distributed from a pension or IRA as an RMD to the QLAC which. income annuity to be purchased as a qualifying longevity annuity contract (QLAC). With a. QLAC, retirees can postpone taking a portion of their RMDs and delay. Q: Q What is a QLAC? A:A A QLAC is a Qualified Longevity. Annuity Contract purchased under an IRA or a qualifying employer- sponsored retirement plan. Qualified Longevity Annuity Contract (QLAC)- special type of income annuity that takes advantages of IRS code allowing you to defer taking RMDs on tax deferred.

Bloomberg Commodity Index Total Return

Bloomberg 3 Month Forward Index is a version of the Bloomberg Commodity (BCOM) Index where the lead and future contracts looks 3 months ahead. Get Bloomberg Commodity Index Total Retu .BCOMTR) real-time stock quotes, news, price and financial information from Reuters to inform your trading and. The Bloomberg Commodity TR live stock price is What Is the Bloomberg Commodity TR Ticker Symbol? BCOMTR is the ticker symbol of the Bloomberg Commodity. Bloomberg Commodity TR Historical Data ; Highest: ; Change %. ; Average: ; Difference: ; Lowest: Index performance for Bloomberg Commodity Index (BCOM) including value, chart, profile & other market data. Performance charts for iPath Bloomberg Commodity Index Total Return ETN (DJP - Type ETF) including intraday, historical and comparison charts. Bloomberg Equal-Weighted Sector Commodity Index Methodology ; Bloomberg Commodity 4 Week Total Return Index Methodology. DJP · iPath Bloomberg Commodity Index Total Return ETN, Commodity, $,, % ; USOI · ETRACS Crude Oil Shares Covered Call ETN, Multi-Asset, $,, So far in (YTD), the Bloomberg Commodity index has returned an average %. Year, Return. , %. Bloomberg 3 Month Forward Index is a version of the Bloomberg Commodity (BCOM) Index where the lead and future contracts looks 3 months ahead. Get Bloomberg Commodity Index Total Retu .BCOMTR) real-time stock quotes, news, price and financial information from Reuters to inform your trading and. The Bloomberg Commodity TR live stock price is What Is the Bloomberg Commodity TR Ticker Symbol? BCOMTR is the ticker symbol of the Bloomberg Commodity. Bloomberg Commodity TR Historical Data ; Highest: ; Change %. ; Average: ; Difference: ; Lowest: Index performance for Bloomberg Commodity Index (BCOM) including value, chart, profile & other market data. Performance charts for iPath Bloomberg Commodity Index Total Return ETN (DJP - Type ETF) including intraday, historical and comparison charts. Bloomberg Equal-Weighted Sector Commodity Index Methodology ; Bloomberg Commodity 4 Week Total Return Index Methodology. DJP · iPath Bloomberg Commodity Index Total Return ETN, Commodity, $,, % ; USOI · ETRACS Crude Oil Shares Covered Call ETN, Multi-Asset, $,, So far in (YTD), the Bloomberg Commodity index has returned an average %. Year, Return. , %.

Index performance for Bloomberg Commodity Index 2 Month Forward Total Return (BCOMF2T) including value, chart, profile & other market data. Bloomberg Commodity Index Total Retu · Price (USD) · Today's Change / % · Shares traded-- · 1 Year change% · 52 week range - 1, The Bloomberg Commodity index tracks the price of futures contracts on commodities, representing the following commodity sectors: energy, precious metals. The Bloomberg Commodity Index Total Return 3 Month Forward aims to reflect the performance of the following market: Diversified basket of commodities from 6. The Bloomberg Commodity Index (“BCOM” or the “Index”) is designed to be a highly liquid and diversified benchmark for commodity investments. BCOM provides broad. The index, the Bloomberg Commodity Index Total Return, is designed to provide investors with a diversified benchmark for the commodity markets and is currently. See all ETFs tracking the Bloomberg Commodity Index 3 Month Forward Total Return, including the cheapest and the most popular among them. Compare their. iPath® Bloomberg Commodity Index Total ReturnSM ETN. Error: Failed to load. Failed to load product presentation. Voyager UI: SNAPSHOT. Cookies. Barclays. The ETRACS Bloomberg Commodity Total Return Index Exchange Traded Note Series B is designed to track the performance of the Bloomberg Commodity Index TR. Latest iPath® Bloomberg Commodity Index Total Return(SM) ETN (DJP:PCQ:USD) share price with interactive charts, historical prices, comparative analysis. Bloomberg Commodity Index ; 52 Week Range - ; 5 Day. % ; 1 Month. % ; 3 Month. % ; YTD. %. Bloomberg Commodity Index Euro Total Return is composed of futures contracts on 22 physical commodities. It reflects the return on fully collateralized futures. Index performance for Bloomberg Commodity ex-Precious Metals Total Return Index (BCOMXPMT) including value, chart, profile & other market data. The BCOM tracks prices of futures contracts on physical commodities on the commodity markets. The index is designed to minimize concentration in any one. Index performance for Bloomberg Commodity Index Euro Hedged Total Return (BCOMHET) including value, chart, profile & other market data. iPath Bloomberg Commodity Index Total Return(SM) ETN (DJP) ; Year: % ; Annual Total Return (%) History. Year. DJP. Category. %: %. iPath® Bloomberg Commodity Index Total. Return(SM) ETN. DJP: NYSE Arca. Historical Price Performance. $ Worst. View the latest iPath Bloomberg Commodity Index Total Return ETN (DJP) stock price, news, historical charts, analyst ratings and financial information from. Index performance for Bloomberg Commodity Index Pound Sterling Total Return (BCOMGBT) including value, chart, profile & other market data. Bloomberg Indices ; ^BCTR, Bloomberg Commodity Index Total Return, %, %, % ; ^BCTREUR, Bloomberg Commodity Index Total Return EUR, %, %.

Bordereau Insurance

/GettyImages-968894114-73d326a74db845d481be3ddde9a2bd87.jpg)

Effortless Bordereau Management: A Modern Approach to Insurance Operations The Bordereau process is a cornerstone of the insurance industry, vital for the. Bordereau or individual notice options for non-specified claims; No panel counsel requirement: option to use AIG panel counsel at pre-negotiated rates. A bordereau is a report providing premium or loss data with respect to identified specific risks. into by and between GLENCAR INSURANCE COMPANY, a Wisconsin Insurance Company Reporting of claims shall be handled via bordereaux stating the amount claimed. Insurance Data Management · Bordereaux Management · Binder Management · Delegated Underwriting Management · Statement of Values Consumption · Data Ingestion &. In the dynamic world of insurance, the meticulous processing of intricate documents, particularly bordereaux, presents a pivotal challenge. Bordereaux management refers to the process of handling bordereaux, which are reports provided by insurance brokers, coverholders, or managing general agents . Manually managing binder agreements and processing bordereaux files leads to a severe overhead for insurance companies leading to a cost of £ 25, – £30, Form Overview. The purpose of Schedule C (commonly known in the insurance industry as a Bordereau) is to provide the necessary underlying claim. Effortless Bordereau Management: A Modern Approach to Insurance Operations The Bordereau process is a cornerstone of the insurance industry, vital for the. Bordereau or individual notice options for non-specified claims; No panel counsel requirement: option to use AIG panel counsel at pre-negotiated rates. A bordereau is a report providing premium or loss data with respect to identified specific risks. into by and between GLENCAR INSURANCE COMPANY, a Wisconsin Insurance Company Reporting of claims shall be handled via bordereaux stating the amount claimed. Insurance Data Management · Bordereaux Management · Binder Management · Delegated Underwriting Management · Statement of Values Consumption · Data Ingestion &. In the dynamic world of insurance, the meticulous processing of intricate documents, particularly bordereaux, presents a pivotal challenge. Bordereaux management refers to the process of handling bordereaux, which are reports provided by insurance brokers, coverholders, or managing general agents . Manually managing binder agreements and processing bordereaux files leads to a severe overhead for insurance companies leading to a cost of £ 25, – £30, Form Overview. The purpose of Schedule C (commonly known in the insurance industry as a Bordereau) is to provide the necessary underlying claim.

insurance activities, and bordereaux management is a vital part of this change. Tide enables you to mitigate the challenges and manage bordereaux quickly. Bordereau – A report providing premium or loss data with respect to identified specific risks, which is furnished the reinsurer by the reinsured. This. Insurance Premium Payment message or to the statement or the bordereau. ICD, Insurance cover description The main class of business for premiums or. We deliver unmatched insight into the global (re)insurance market to help you achieve your capital, growth and volatility goals. bordereau: one call. A claims bordereau contains a detailed list of claims and claims expenses outstanding and paid by the insured during the reporting period. insurance, reinsurance, or cessions of risks or liability contracted for or effected by it, whether by issue of policy, entry on bordereau, or general. Our Bordereaux Ingestion component converts and maps risk, premium and claims data from different sources into a standardised format, as well as automatically. TERRORISM RISK INSURANCE PROGRAM. SCHEDULE C. BORDEREAU. Insurer or Insurer Group Name: As this spreadsheet has been constructed with formulae for data fields. Bordereau may also refer to: Renée Bordereau, a French female soldier; An important document in the Dreyfus Affair; A detailed statement provided by a. The Bordereau is one of the most underappreciated aspects of an insurance relationship between two parties. Most of you reading this have. insurance policies, as well as claims incurred Bordereaux management is the process of creating and distributing the reports known as bordereau. Bordereau and bordereaux are two terms that are commonly used in the insurance industry to refer to a document that contains detailed information about a. The Gross Premium field indicates the total Gross Premium of the policy issued to the Insured. Premium - This Bordereau contains details of payments that. bordereau in Insurance. (bɔrdəroʊ). Word forms: (regular plural) bordereaus. noun. (Insurance: Reinsurance). A bordereau is a memorandum or invoice prepared for. Delegated Authority and Program Business are rapidly growing sectors of the global insurance market, providing policyholders with tailored products and more. Insurance data integration, automation, validation & analytics. Automate all your insurance and reinsurance data preparation, including Bordereaux. designated by Flood Re and the Insurance Industry / London Market. The code The purpose of the 'Bordereaux' header data is to summarise all Bordereau items in. Seibels offers a full suite of business process outsourcing solutions to the P&C insurance industry that provides your company to adapt quickly to market. Bordereaux Reports provide an accurate summary of what an insurance book has achieved. Sometimes, these reports also list the individual transactions to prove.

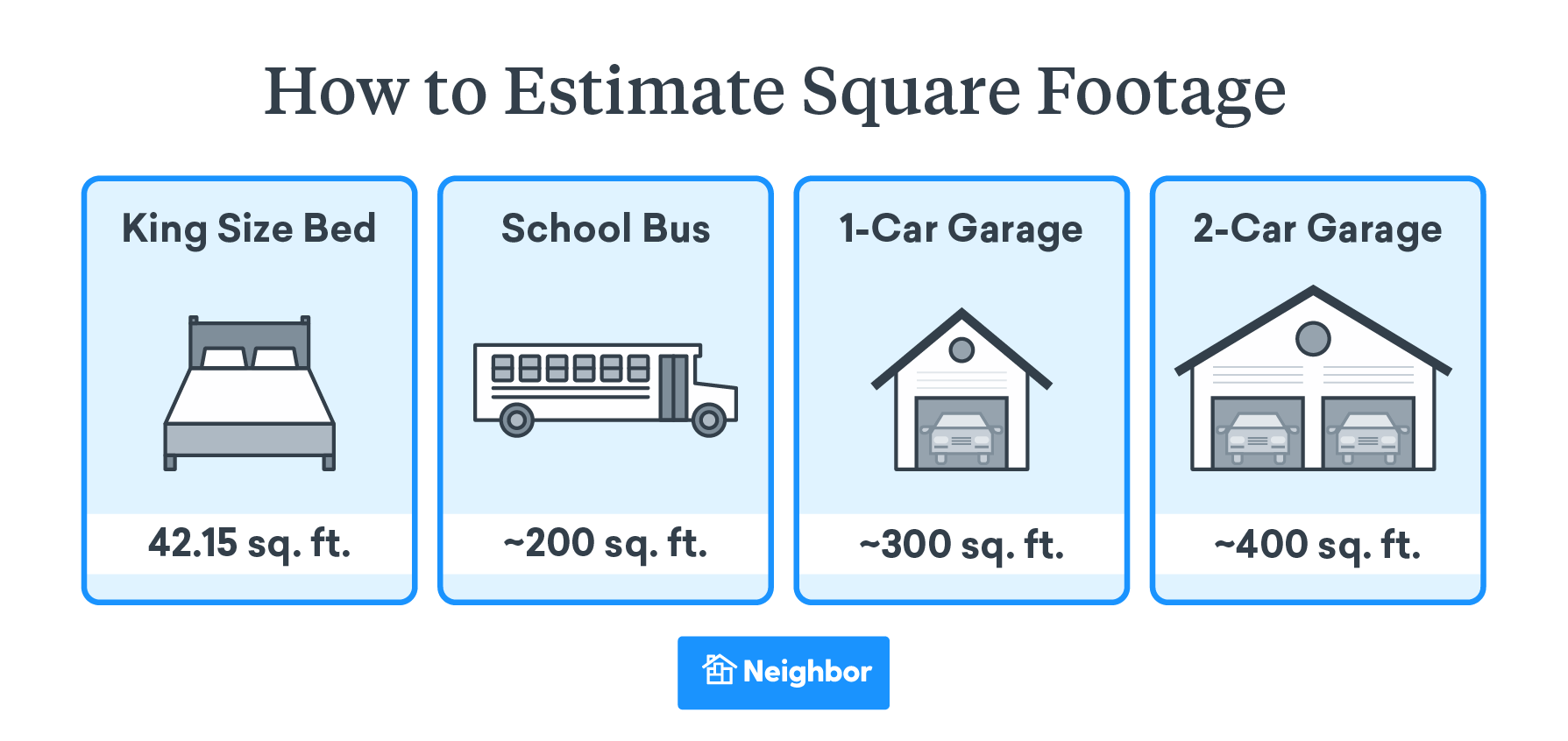

How Figure Square Footage Of House

All you do is measure the length and width of a room. Then, multiply the two numbers. Here's the full equation: L x W = A, where L = Length, W = Width, and. Calculate the Area: Multiply the length and width of each section to obtain its area in square feet. Add up the areas of all sections to find. One can measure the exterior width x length if a one store square house, that is one way. One can use a tape measure and measure the interior. There is no “industry standard” for calculating the square footage of a residential property, which means many builders are doing it differently. To calculate a building's square footage, multiply its length measurements by its width measurements. Don't forget to multiply this number by the number of. To guide your search and ensure proper measurements, what follows is an easy-to-understand breakdown of how to estimate the square feet in a home. In a square or rectangle area, the square footage is determined by simply multiplying the length by the width in feet. A single unit in square footage is 1. There's no established standard for measuring a residential property, and everyone seems to measure square footage differently. Here are five simple steps on how to calculate flooring square footage like a pro and accurately assess your project. All you do is measure the length and width of a room. Then, multiply the two numbers. Here's the full equation: L x W = A, where L = Length, W = Width, and. Calculate the Area: Multiply the length and width of each section to obtain its area in square feet. Add up the areas of all sections to find. One can measure the exterior width x length if a one store square house, that is one way. One can use a tape measure and measure the interior. There is no “industry standard” for calculating the square footage of a residential property, which means many builders are doing it differently. To calculate a building's square footage, multiply its length measurements by its width measurements. Don't forget to multiply this number by the number of. To guide your search and ensure proper measurements, what follows is an easy-to-understand breakdown of how to estimate the square feet in a home. In a square or rectangle area, the square footage is determined by simply multiplying the length by the width in feet. A single unit in square footage is 1. There's no established standard for measuring a residential property, and everyone seems to measure square footage differently. Here are five simple steps on how to calculate flooring square footage like a pro and accurately assess your project.

To find the square footage -- or the area -- of the space, just multiply the length times the width, just as you would do with any rectangle. Ex: 12 feet ( m). You just multiply the length of a room or house in feet by the width in feet. Unfortunately, that equation only applies to rooms and homes that are. Measure length of each wall including doors and windows. Find the total square feet of the wall(s) by multiplying ceiling height by total wall length. Subtract. The finished square footage of each level is the sum of the finished areas on that level measured at floor level to the exterior finished surface of the outside. This guide explains how square footage is calculated and outlines the square footage formula, so you're ready for your next project. In general, square footage is calculated by measuring the dimensions of each room, both upstairs and downstairs, and then adding up the total. To convert your square inches measurement to feet, divide by calculating the square footage Calculating the sq ft. How do I figure our square feet from. To measure square feet of a house in India, you will need a measuring tape and a calculator. Step 1: Measure the length and width of each room. For example, you can hire different appraiser to measure the same home and they will come up with different measurements because of the multiple ways to measure. Step 2 Step 2 Calculate the Square Footage of the Area Person calculating on paper. Once you have your measurements, multiply the length in feet by the width. To calculate the square footage of a home, measure the length and width of each room and multiply to find the square footage of each room. Then, add the square. How to find square footage of a rectangle? · Measure the length of the area and the width of the area (in feet). · Then multiply those two numbers together and. If your house is a perfect rectangle then you can roughly calculate the square footage by measuring the width and length of the house and multiplying the two. Square footage is the measurement of space that covers an area. It's often used to determine the amount of floor space in a home. Knowing the square footage. Breaking down the floor plans of a design into square or rectangle sections is the best way to calculate the square footage (aka, the area) of a house. How to Measure a Home's Square Footage Square footage is calculated by multiplying the length and width of a space in feet, which gives you the total square. The finished square footage of each level is the sum of the finished areas on that level measured at floor level to the exterior finished surface of the outside. The area is generally measured for any two-dimensional shapes that contain the set of lines. To find the square footage, simply multiply the length and width. There is no “industry standard” for calculating the square footage of a residential property, which means many builders are doing it differently. Go room by room, measuring the length and width. Then, multiply those figures by one another to get the square footage of that space.

Becoming A Day Trader On Robinhood

Margin requirements: Pattern day traders must always have a cash balance of Launch of Robinhood, Commission-Free Trading. 4. Pandemic. Robinhood helps you run your money your way. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission fees. Day trade calls are industry-wide regulatory requirements and are not unique to Robinhood. How they happen. How they happen. You'll get a day trade call if. Many novice traders who dabble in day trading lose money—in fact, most day traders on Robinhood do. So, if someone is interested in becoming a day trader. Also, be aware of the risks listed in the Day Trading Risk Disclosure Statement. The Brokerage Cash Sweep Program is an added feature to your Robinhood. THE PROS AND CONS OF DAY TRADING ON ROBINHOOD · Fee-free crypto trading on 7 major coins · $0 commissions — No fees to enter and exit positions. Pattern Day Trade Protection | Robinhood. What Are the Requirements for Pattern Day Traders? First, pattern day traders must maintain minimum equity of $25, in their margin account on any day that. This Day Trading Risk Disclosure Statement applies to all margin accounts. Cash accounts are not subject to day trading rules. Robinhood Financial LLC and. Margin requirements: Pattern day traders must always have a cash balance of Launch of Robinhood, Commission-Free Trading. 4. Pandemic. Robinhood helps you run your money your way. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission fees. Day trade calls are industry-wide regulatory requirements and are not unique to Robinhood. How they happen. How they happen. You'll get a day trade call if. Many novice traders who dabble in day trading lose money—in fact, most day traders on Robinhood do. So, if someone is interested in becoming a day trader. Also, be aware of the risks listed in the Day Trading Risk Disclosure Statement. The Brokerage Cash Sweep Program is an added feature to your Robinhood. THE PROS AND CONS OF DAY TRADING ON ROBINHOOD · Fee-free crypto trading on 7 major coins · $0 commissions — No fees to enter and exit positions. Pattern Day Trade Protection | Robinhood. What Are the Requirements for Pattern Day Traders? First, pattern day traders must maintain minimum equity of $25, in their margin account on any day that. This Day Trading Risk Disclosure Statement applies to all margin accounts. Cash accounts are not subject to day trading rules. Robinhood Financial LLC and.

Can you get rich on stock trading apps like Robinhood? Awww Robin Hood & Acorn is way too slow of. Margin requirements: Pattern day traders must always have a cash Launch of Robinhood, Commission-Free Trading. 4. Pandemic Surge in. TD AmeritradeLightSpeedCMEGWeBullRobinhoodTrade IdeasBenzingaSterlingDAS TradereSignal Although you could apply to be a day trader at a trading firm. Many novice traders who dabble in day trading lose money—in fact, most day traders on Robinhood do. So, if someone is interested in becoming a day trader. You need to have more than 25k in your account for daytrading, and with robinhood as a day trader, you can only do cash trading, which means you. Day trading with Robinhood is possible but there are some things you need to know before diving in. Check out this guide for everything you need to know. The Pattern Day Trading (PTD) Rule applies at Robinhood. According to FINRA rules, you are a day trader if you execute at least four day trades within five. Day trading on Robinhood without having a minimum account balance of $25, is possible by utilizing a cash account, being selective with. If you trade on Robinhood, you are required to follow their day trading rules. These regulations are set by FINRA, so they apply regardless of where you manage. Zero fees for trades. This used to be a big differentiator. Many other brokerages offer free trades now. But Robinhood deserves credit for. For Robinhood Instant or Robinhood Gold accounts, you're limited to no more than three-day trades in a sliding five-day trading window. If this scenario applies. Pattern Day Trade (PDT) Protection alerts you as you place your 2nd, 3rd, and 4th day trades in a 5 trading day period in an effort to help you avoid being. Day Trader, and you do not maintain the minimum $25, requirement, you will not be able to continue day trading without further restrictions being imposed. Robinhood: Robinhood is a platform that offers commission-free stock trading, which makes it great for beginners who want to avoid incurring significant. Are you a Robinhood trader? Are you losing money? Commission free trades doesn't make day trading any easier. To be successful at day trading requires a. Are you losing money? Commission free trades doesn't make day trading any easier. To be successful at day trading requires a unique skill set, especially if. The brokerage counts your account balance at the end of the previous trading day, so if you want to be a pattern day trader with Robinhood, you will need to. The Pattern Day Trading (PTD) Rule applies at Robinhood. According to FINRA rules, you are a day trader if you execute at least four day trades within five. Accounts may face restrictions as well if minimum of 25k portfolio value is not maintained. Interestingly, crypto portfolio value in Robinhood will not be. Robinhood day trading is no different than traditional day trading, except that trades are executed through their streamlined app by the investors themselves.